Credible Personal Loans Loans

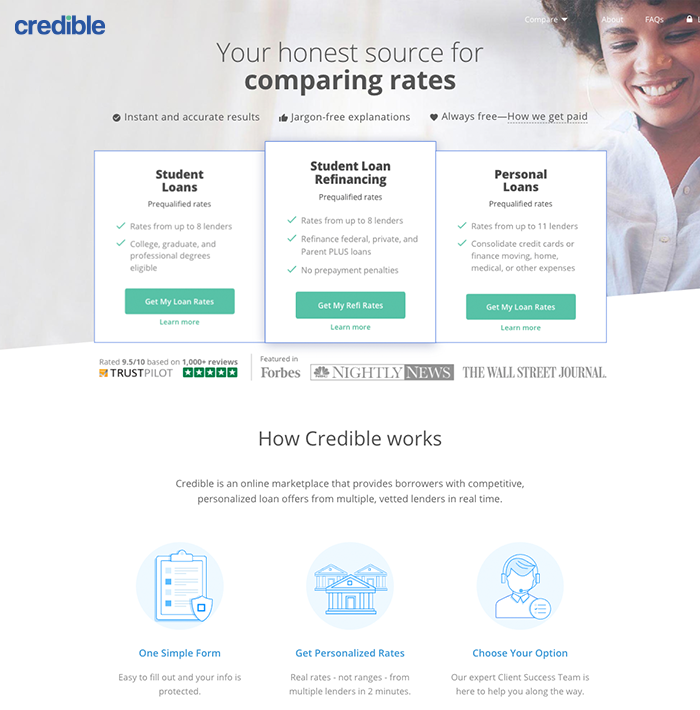

Credible is a top rated online loan marketplace that connects borrowers with fair to excellent credit to a network of vetted lenders. Read on to learn pros, cons, pricing, and more.

visit lineCredible Personal Loans Review

Since 2012, Credible has served customers as a personal loan marketplace, helping borrowers connect with lenders that serve people with their credit profiles. That makes it easier to get personalized quotes and qualify for loans.

Visit Credible Personal Loans LoansView Loan Offers

Credible Personal Loans Pros

- $200 Best Rate Guarantee: Close with a better rate than you prequalify for on Credible and get a $200 gift card.

- Accredited and top rated service: Credible is BBB accredited with an A+. As of May 2022, Credible is rated a 4.7 out of 5 on TrustPilot (a 3rd party review site) with 5092 customer reviews.

- No fees: Credible's service is completely 100% free to use.

- Simple 2-minute form: Borrowers can receive approval from Credible's partner lenders in a matter of minutes.

- Large loan marketplace: Credible has a large network of vetted lenders that you can reach simply by filling out one form. This allows you to look through several options before deciding on the best loan for you.

- Great customer service: Credible's customer service has representatives available by phone, email, or online chat.

- Accurate rate comparison: When you apply with Credible, you will see the actual rates you prequalify for due to the fact that they are directly connected to the three major bureaus.

- Secured with 256-bit encryption

Credible Personal Loans Cons

- Credible customers complained that once they chose a prequalified offer and submitted their personal information, they were contacted frequently with phone calls and emails by Credible (not the lenders).

- Although Credible does not charge any fees for their services, your lender may charge additional fees (such as origination fees, processing fees, and ACH transfer fees). Be sure to read the terms and conditions carefully before signing any documents.

How to Apply for a Credible Personal Loans Personal Loan?

You can apply for a personal loan from Credible by visiting the company’s website. To get started, you’ll need to create an account. From there, you can fill out the application, which asks for the following information:

- Your name

- Date of birth

- Social Security number

- Estimated credit score

- Employment information

- Annual income before taxes

- How much you want to borrow

- Monthly housing expenses

- What you plan to use the funds for\

- Your highest completed level of education

Based on the details that you provide, the Credible will send your information to its partner lenders. Credible does its best to send your details to lenders that are likely to approve you for a loan.

Terms & Requirements

Given that Credible is free to use and there’s no obligation or impact on your credit, almost anyone can benefit from applying for a loan through Credible.

- You must be a US citizen or permanent resident

- You must be at least 18 years of age

- You must have a valid checking account in your name

- You must have fair to excellent credit -- usually a credit score of 600+

Credible Personal Loans Pricing

- Credible is a 100% free to use loan comparison service.

- Credible's lending partners offer loans between $1,000 to $200,000.

- Fixed rates range from 6.49% to 35.99% APR.

- Loan terms range from 1 to 7 years.

How Does Credible Personal Loans Work?

Credible is a personal loan marketplace. That means that Credible doesn’t offer loans directly to borrowers. Instead, it serves as a matchmaker for borrowers and lenders.

Credible has a list of partner lenders, including some of the top loan companies in the United States. When a borrower visits Credible’s website, they can fill out a basic application with details like their credit, financial situation, and the type of loan they want to get. Credible reviews that application and selects lenders that it thinks are likely to approve that borrower for a loan.

Those partner lenders review the borrowers’ details and submit quotes for loans. Then, you can review those quotes and choose the one that works best for you. Best of all, there’s no impact on your credit to get these quotes and no cost or obligation to move forward if none of the offers are appealing to you.

For Whom Credible Personal Loans is Good?

Credible is a good choice for borrowers who want to make it easy to compare multiple personal loan offers. The company generally focuses on people with good to excellent credit, so you should give the company a look if you have a solid credit rating.

Given that Credible is free to use and there’s no obligation or impact on your credit, almost anyone can benefit from applying for a loan through Credible.

Credible Personal Loans Alternatives

Customer Testimonials

Below are some real customer reviews left on Trustpilot:

This is the second time I’ve used credible. It’s so easy and made refinancing my student loans a breeze both times!

Definitely got the best rate by shopping on Credible. Bonus, it didn’t require multiple credit checks and credible was still able to search multiple providers to find the very best rate. Also, super easy process. Thanks for the savings!

Was simple to use and easily digestible for something I had really no idea about how to handle. It made it easy to choose between different loans and institutions I would’ve been lost without it.

Summary

Credible is a very reputable company that offers a variety of services, including connecting borrowers to a network of vetted personal loan lenders. If you have good or excellent credit, we recommend using Credible's free service to see your loan options.

Contact Credible

Email: support@credible.com

Phone: 866-540-6005

Address: 110 Corcoran Street 5th Floor Suite 151 Durham, NC 27701

Frequently Asked Questions

What makes Credible's loan comparison service unique?

Credible offers a $200 Best Rate guarantee if you find a better rate elsewhere. Along with being a personal loan marketplace, Credible works with multiple lenders in their network that offer a variety of additional services such as credit cards, mortgages, student loans, and student loan refinancing.

Will comparing financial products through Credible hurt my credit score?

To provide pre qualified rates, Credible simply performs a soft credit inquiry (which does not damage your credit in any way). However, if you decide to proceed with a selected lender, that lender may perform a hard credit inquiry.

How does Credible make money if it's a free service?

Credible is a completely free service for consumers, but they are paid a commission by their partners for referring borrowers.